Author: admin

How to Invest in Collectible Watches and Jewelry

admin - January 25, 2026Introduction to Investing in Collectible Watches and Jewelry Investing in collectible watches and jewelry can be a lucrative endeavor for those who appreciate the art and craftsmanship inherent in such pieces. While traditional investments may seem more straightforward, collectibles offer unique opportunities and, at times, significant returns. This article aims to provide guidance on how

The Future of Space Exploration Investments

admin - January 8, 2026The Growing Investment in Space Exploration Over the past few decades, investment in space exploration has seen a marked increase, driven by both governmental ambitions and private sector interest. This shift signifies the growing recognition of the potential economic and scientific benefits that space exploration can offer. Governmental Role in Space Investment Governments have historically

How to Invest in Green Energy and Renewable Resources

admin - January 1, 2026Understanding Green Energy Investment Investing in green energy and renewable resources is becoming increasingly essential as the global demand for sustainable solutions rises. Green energy investment not only helps in reducing carbon emissions but also provides stable and potential growth opportunities for investors. This article will guide you through the essentials of investing in green

The Role of Impact Investing and ESG Investments

admin - December 25, 2025The Rise of Impact Investing and ESG Investments Impact investing and Environmental, Social, and Governance (ESG) investments have experienced a substantial rise in prominence, transforming the global financial landscape. The inclination towards responsible investment options has become a catalyst for significant changes, prompting reassessment in practices and strategies by both investors and companies. This shift

Investing in Classic Cars and Luxury Vehicles

admin - December 25, 2025Introduction to Investing in Classic Cars and Luxury Vehicles Investing in classic cars and luxury vehicles occupies a unique niche within the broader spectrum of collectible markets. This pursuit blends a passion for history and engineering with the possibility of financial returns. However, like any investment, delving into this market requires thorough research and a

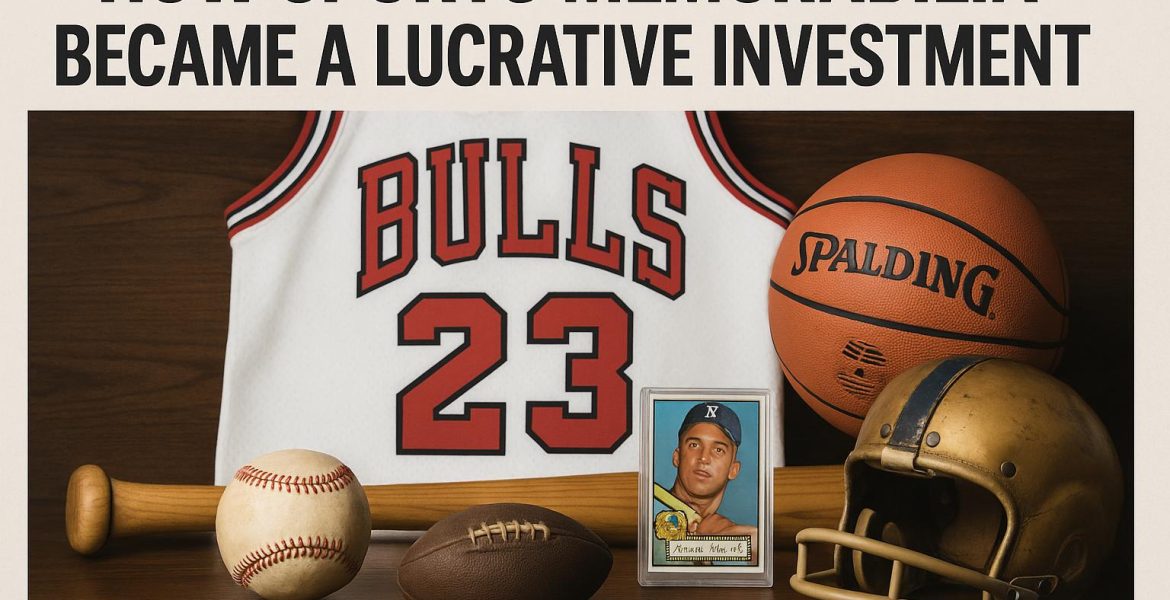

How Sports Memorabilia Became a Lucrative Investment

admin - November 27, 2025The Rise of Sports Memorabilia as an Investment Sports memorabilia has experienced a remarkable transformation over recent years, evolving into a significant alternative investment asset. Initially the passion of avid fans and collectors, the sector is now recognized for its potential financial gains, attracting various investors who see value in this emerging market. Historical Context

The Potential of Music Royalties and Intellectual Property Investing

admin - November 20, 2025The Emergence of Music Royalties as an Investment Vehicle Music royalties have increasingly become an attractive avenue for investors seeking alternative asset classes. These financial benefits are derived from the intellectual property rights related to music, providing a consistent stream of income. The music industry, historically dominated by record sales and live performances, has evolved

Investing in Farmland and Agricultural Land

admin - November 19, 2025The Appeal of Farmland Investments Investing in farmland and agricultural land has emerged as an appealing option for many investors aiming to diversify their portfolios. This type of investment stands out due to several unique attributes compared to more traditional investment vehicles such as stocks and bonds. Notably, farmland has the potential for long-term capital

How to Make Money with Domain Name Investing

admin - November 6, 2025Understanding Domain Name Investing Domain name investing, often called domain flipping, has emerged as a formidable means of generating revenue through digital assets. This process entails acquiring domain names with the objective of selling them later at higher prices. Engaging in domain name investing can prove to be lucrative, but success hinges on an investor’s

The Rise of Crowdfunding and Peer-to-Peer Lending Investments

admin - October 30, 2025Crowdfunding: A New Era of Investment Crowdfunding has increasingly become a noteworthy method for fundraising, fundamentally altering the landscape of investment opportunities. Over the past ten years, this innovative approach has morphed from a nascent idea nurtured by creative thinkers to an indispensable component of the global business environment. Renowned platforms such as Kickstarter, Indiegogo,