Month: March 2025

The Pros and Cons of Alternative Investments

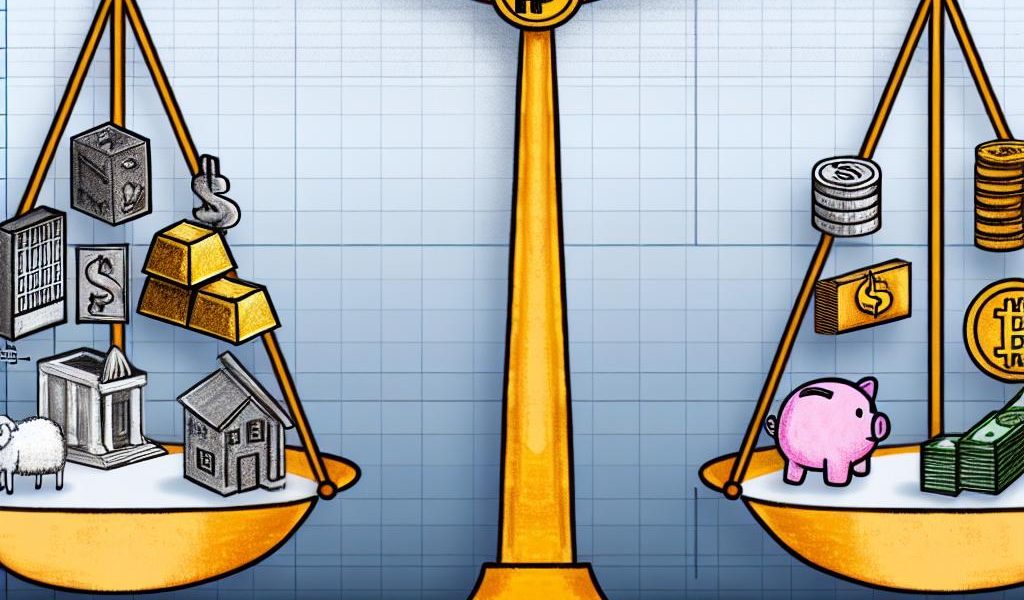

admin - March 23, 2025The Pros and Cons of Alternative Investments Alternative investments, often referred to as “alternatives,” encompass a broad spectrum of assets that fall outside the realm of traditional investment vehicles like stocks, bonds, and cash. The common types of alternative investments include private equity, hedge funds, real estate, commodities, and tangible assets such as art and

Alternative Investments vs. Traditional Investments: Key Differences

admin - March 16, 2025Understanding Alternative Investments Alternative investments are financial assets that do not fit neatly into the traditional categories of stocks, bonds, or cash. They embody a broad spectrum of asset types, including real estate, commodities, private equity, hedge funds, art, and collectibles. With their unique characteristics, alternative investments often attract investors looking to diversify their portfolios

What Are Alternative Investments? A Beginner’s Guide

admin - March 9, 2025Understanding Alternative Investments Alternative investments refer to any investment outside the traditional categories of stocks, bonds, and cash. These investments can include assets such as real estate, commodities, hedge funds, private equity, and more. While alternative investments often require a higher level of expertise and due diligence, they can offer opportunities for portfolio diversification and

What is forex day trading?

admin - March 9, 2025Understanding Forex Day Trading Forex day trading involves buying and selling currency pairs within the same trading day. The foreign exchange market, known as forex, is a global decentralized market where currencies are traded. This market operates 24 hours a day during weekdays, providing ample opportunity for traders to execute numerous transactions. Basic Concepts Currency